Tame your Data. Balance Risk. Build Value.

DPMX is an innovative project and portfolio management system that is based in solid, proven decision analytics and backed by enterprise-level data management tools – effectively stamping out the labyrinth of email, conflicting spreadsheet revisions and “which are the latest results” debacles so teams can focus on what matters most – creating portfolio value!

Unique Features Include:

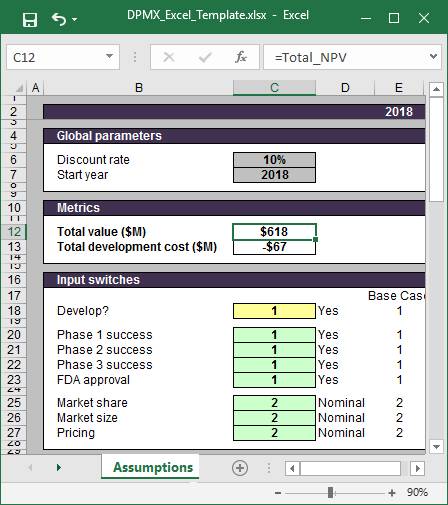

Managed Excel Inputs

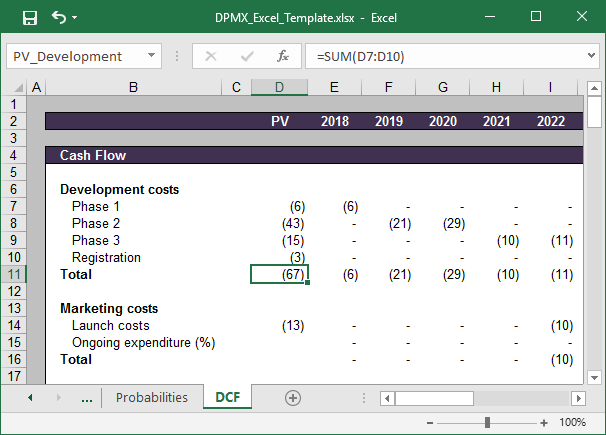

Project managers and subject matter experts provide project-specific inputs to the DPMX System via an Excel spreadsheet – a familiar, learn-nothing-new valuation environment. Not only does the spreadsheet furnish a familiar environment for data elicitation, it also provides real time feedback of project valuation metrics, increasing ownership and reducing errors. The Excel spreadsheet contains all of the data necessary to evaluate the project including the complete implementation of the valuation model. Virtually anything that can be modeled in an Excel spreadsheet can be built into the valuation model.

Download and take a closer look at an example DPMX Excel Template:

DPMX

Excel Template

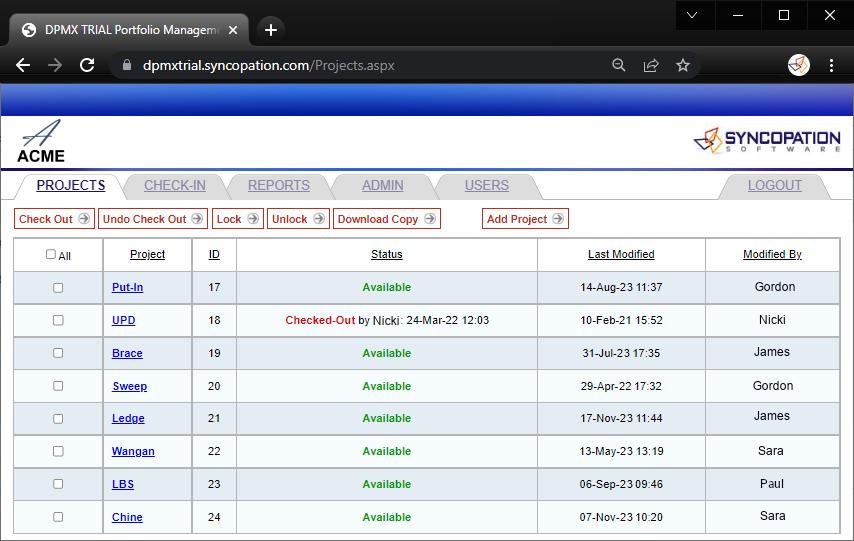

A Secure, Centralized Database

A centralized database stores input data for all projects in the portfolio. When a user checks out a project from the system for editing, DPMX populates the Excel spreadsheet with project data stored in a secure, centralized database. Once the user completes making changes, s/he checks the Excel spreadsheet back into DPMX. DPMX uploads the data to the central portfolio database.

The database provides multi-user access with tracking of changes and retention of historical versions, eliminating the confusion that can occur with simultaneous edits. You define levels of user read and/or write access to project data at the individual project, business unit or portfolio level. Define levels of access to analytical results with the same granularity. For more on DPMX, Excel, and the Database see:

The DPMX Portal

The DPMX Portal is an intranet portal that serves as the hub of the portfolio analysis system. It streamlines the portfolio review process via a central access point for everything from the check-out/check-in of projects, the presentation of results and system configurations. DPMX re-evaluates the portfolio on a schedule that you determine: hourly, twice daily, daily, etc.

The central database stores portfolio analysis results for on-demand access to a complete suite of graphical and numeric reports (shown below) that allow you to visualize portfolio balance and rank projects based on capital efficiency. Further, users can add custom reports and charts that provide insights to metrics important to their organization.

You choose whether to host the DPMX Portal yourself or have us host your DPMX Portal in the cloud.

DPMX

Web Portal - Project Check-out

Primary Graphical Outputs

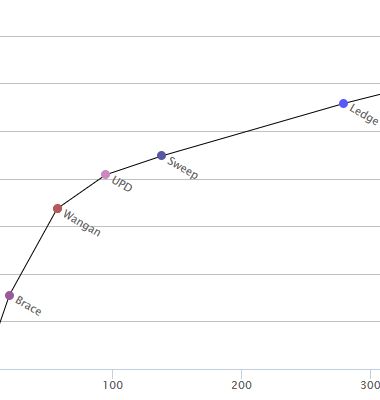

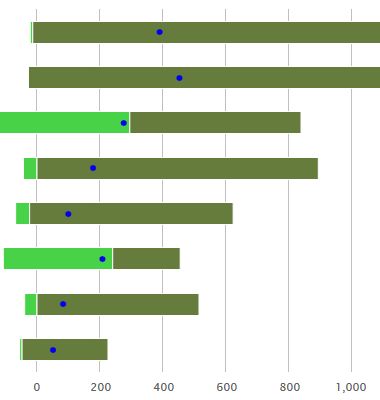

Productivity Ratio

Rank projects based on a ratio of expected benefits over expected resource requirements

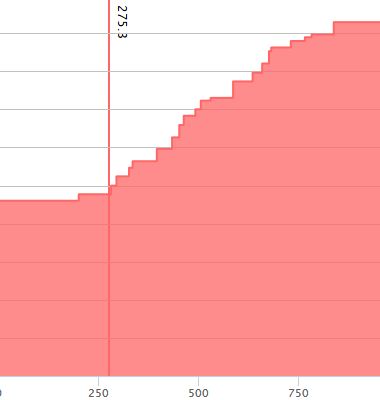

Risk Profile for a Single Project

Gain a deeper understanding of the riskiness of a project by viewing the complete distribution of value

Project Value Range

Realize the full range of value (P10 - P90) for each project in the portfolio

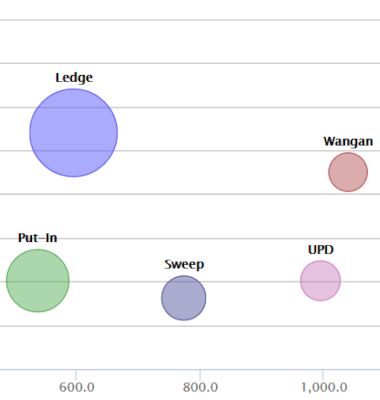

Risk/Reward

Attain portfolio balance – visualize high risk/high reward projects and “sure bets”

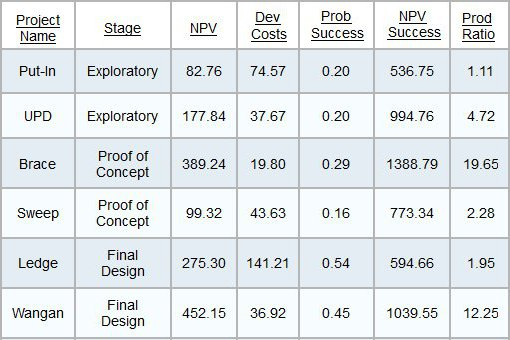

Robust DPL Analytics

DPL Portfolio, the class-leading decision analytic portfolio platform, serves as the analytic engine for the system. It defines the portfolio-wide metrics used to evaluate projects in the portfolio and calculates overall portfolio level results. In addition to expected metrics, the probability of success of each project is calculated based on the underlying uncertainties in the valuation models. The riskiness of a project is an OUTPUT of the system not a back-of-the-envelope guesstimation that you enter into the system. The system aggregates project level results to provide metrics for the overall portfolio. In addition to expected/probabilistic results, DPL Portfolio calculates base case or given success results for each project.

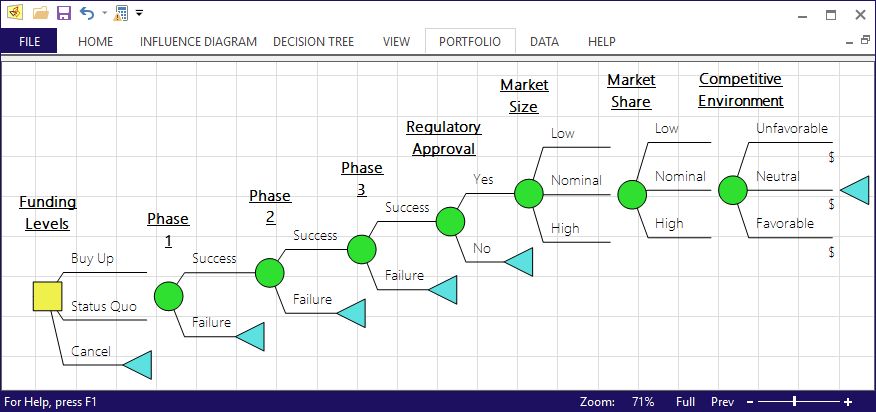

Intuitive Template Models

DPMX represents the portfolio of projects via standardized template models. A template model consists of:

A flexible, intuitive decision tree describing the timing and structure of decisions and uncertainties common to the projects represented by the template model DPMX Decision Tree Model Template

An Excel cash flow spreadsheet which provides the valuation model for the projects.

A portfolio in DPMX can contain multiple template models depending upon the nature of the portfolio being evaluated. But note that not every project has to fit a mold; there is unlimited customization for critical and/or one-of-a-kind projects. Custom models for projects requiring extra attention can be incorporated into the system.

The DPMX System uses Excel spreadsheets that have been automatically converted into DPL native code to provide huge performance boosts when analyzing the portfolio while also maintaining the ability for users of the system to work in the familiar Excel environment when providing inputs.

Fast, Headache-free Implementation

Class-leading DPL Decision Tree Engine for Analytics

Convenient & Flexible Excel Spreadsheets for Valuation

Robust & Secure Database Powered Intranet