Oil & Gas

LNG Regas Opportunity

Natural gas in it’s liquid form (LNG) can skirt pipeline infrastructure and instead be transported by special ships to LNG import facilities for regasification to then be distributed to market. Recently, the costs associated with building these LNG import and export facilities and transportation mechanism has risen dramatically. At the same time the US is experiencing a natural gas boom. Consequently, many firms are now scrambling to re-invest capital to convert or add export capabilities to their LNG import facilities.

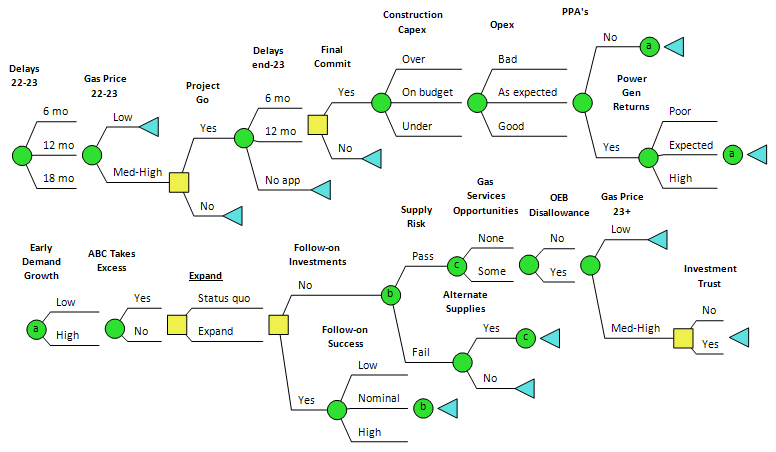

The final investment decision to build, convert, or increase capacity is plagued by a variety risks and uncertainties – including regulatory hurdles, commodity prices, natural gas price volatility and market swings. DPL can provide a comprehensive, coherent framework for incorporating all these drivers of uncertainty and value, and produce a transparent, defensible recommendation.