After much ado the Federal Reserve decided to maintain interest rates at their current levels this past Wednesday – which wasn’t much of a surprise to most. The Syncopation team saw an opportunity to drum up the drama surrounding the Fed’s upcoming November meeting by offering potentially huge savings on DPL licenses, with the amount of savings depending on the outcome of the FOMC’s Nov 2 meeting. As a bonus, we’re also providing a quick lesson on the value of imperfect information through our promotion. Read on for all the details.

The Decision: Lock in Savings Now or Hope for More?

Here is how the Fed Rate Hike DPL Promotion will work:

- From today to Oct 11, we are offering a 25% discount on licenses of DPL 8

- From Oct 12 (the date the meeting minutes are published) to Nov 1, the DPL discount will decrease to 15%

Now here is the kicker:

- If the Feds decide to keep rates at their current level on Nov 2, the promotion will end on that date

- If the Feds decide to raise rates on Nov 2, the discount will increase to 35% and run through Nov 30!

You are not totally on your own in the face of this uncertainty, as there will be an opportunity to gain some (imperfect) information on the Fed’s November decision when the meeting minutes for Wednesday’s meeting are published on October 12th. But how much value can you add from reading these tea leaves?

The Model: Buy DPL Now vs. Buy DPL Later

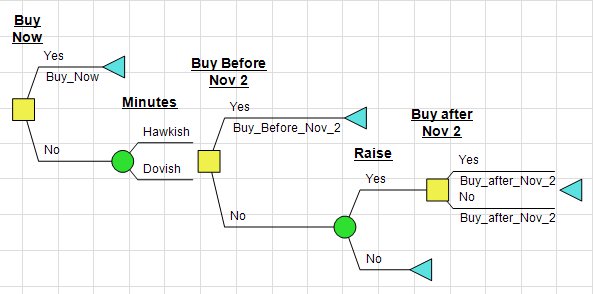

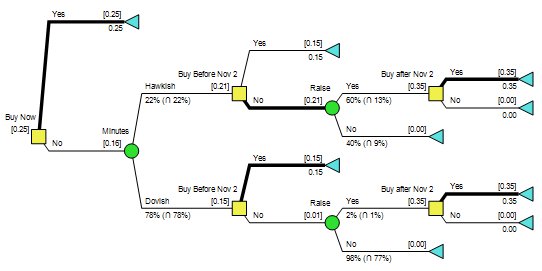

We’ve provided a DPL Decision Tree model to help you with the timing decision of your purchase:

The initial decision is whether to buy now and receive the 25% discount or wait. Next is an uncertainty that provides a learning opportunity for future decisions – the hallowed meeting minutes! The outcome will either be a Hawkish tone (inflation is just around the corner!) or a Dovish one (no hurry, the economy has lots of slack). This leads into a downstream decision: whether or not to cash in on the slightly diminished 15% discount between Oct 12 and Nov 2.

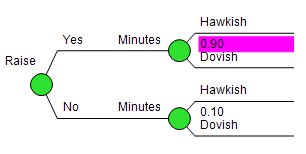

Next comes the Raise uncertainty, the outcome of which conditions the probabilities of the Minutes uncertainty. This is an example of Bayesian revision, in other words we assess conditional probability information one way (Raise then Meeting minutes) but encounter the events chronologically in the reverse order. The last decision is pivotal, after assessing those meeting minutes should you continue to roll the dice in hopes of getting 35% off DPL at the risk of receiving nothing?

The Numbers

We gleaned the probability data for the Fed raising rates in November from a handy tool by the CME Group:

http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

For probabilities for the Minutes uncertainty, we had to make some assumptions and we assumed that the minutes provide really good imperfect information (~90%). Do you think the tea leaves will be less informative? Feel free to download the model and use your own numbers.

So What is the Optimal Policy?

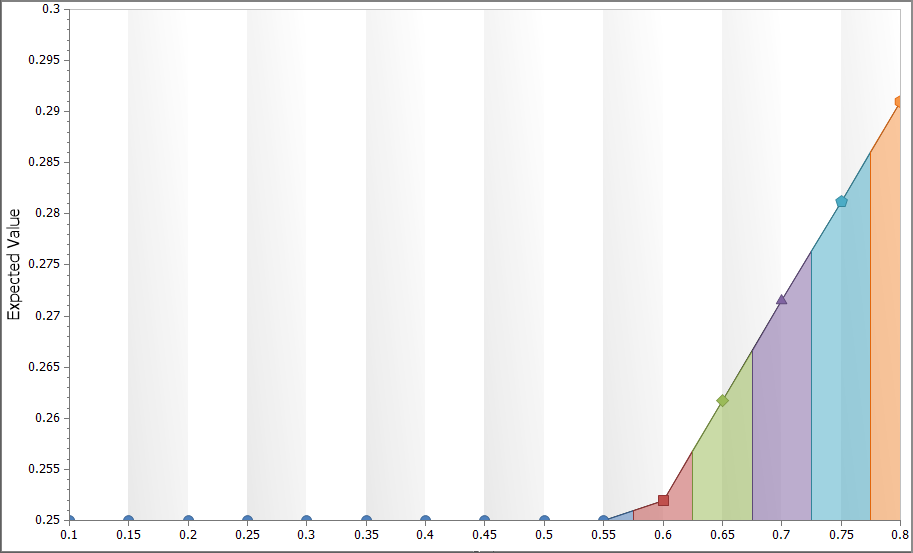

DPL’s Policy Tree output tells us it’s best to take the 25% discount and run with it. But let’s say you have a hunch that the Feds will raise rates in November. That’s no problem, in DPL you can run a rainbow diagram on the probability of a rate hike. It turns out the probability of a rate hike must be greater than 55% for buy now not to be optimal decision policy – the probability of a November hike now stands at about 15%. Are you that sure the hawks will suddenly emerge?

If you’d like to take a closer look, you can download the DPL Model

here:

Fed Rate Promo.da