What is DPL?

DPL is a standalone, desktop application for decision and risk analysis, decision-tree based real option analysis, and Monte Carlo simulation. It’s a comprehensive tool that supports the entire decision analysis process – incorporating a unique influence diagram/decision tree combination for decision framing and structuring, extensive support for Excel linking, a variety of sensitivity analyses options, and insightful outputs that can help you understand and communicate:

- the best course of action in the face of uncertainty

- the degree of risk in an asset or situation

- the value of an investment

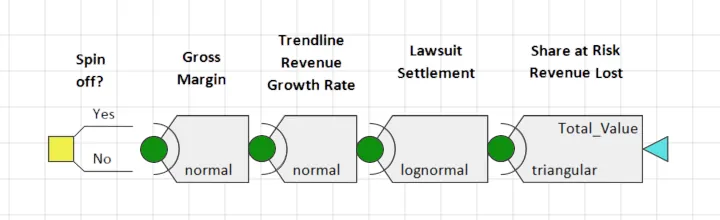

DPL gives you options for modelling uncertainty. But fundamentally, DPL is either evaluating a discrete or a continuous model. If you have any continuous chance nodes in your model, you’ll be running a Monte Carlo simulation; otherwise, you have a tree with finitely many paths, and you’ll run some kind of decision tree method.

What are the benefits to using DPL for Monte Carlo Simulation?

- DPL’s Monte Carlo is built on a fast decision tree engine, so it supports advanced outputs like the Policy Summary and Policy Tree.

- DPL can convert your spreadsheet to DPL native code, resulting in speed increases of 10-100 times, in this way you can avoid the random noise of small sample runs without paying the price in long runtimes.

- DPL supports downstream decisions, enabling serious real options analysis, where the policy isn’t an =IF statement.

- You can mix discrete and continuous elements to build asymmetric hybrid models.

How do you do Monte Carlo Simulation in DPL?

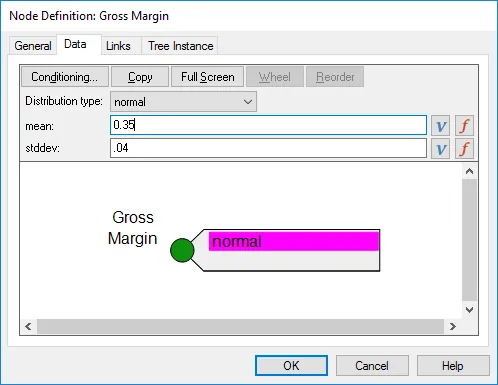

To use Monte Carlo simulation in DPL, you must have one or more continuous chance nodes in your model. During a Monte Carlo Simulation run the continuous chance nodes(s) are simulated by drawing random samples from named distributions with specified parameters. It produces an approximate expected value and Risk Profile percentiles.

DPL allows both traditional Monte Carlo using samples for continuous chance nodes and Discrete Tree Simulation for finite trees. DPL’s traditional Monte Carlo Simulation uses independent random samples. DPL’s Discrete Tree simulation can either use independent samples or a method we call “distributed sampling” which exactly matches the probability distributions of the higher chance nodes in the tree.

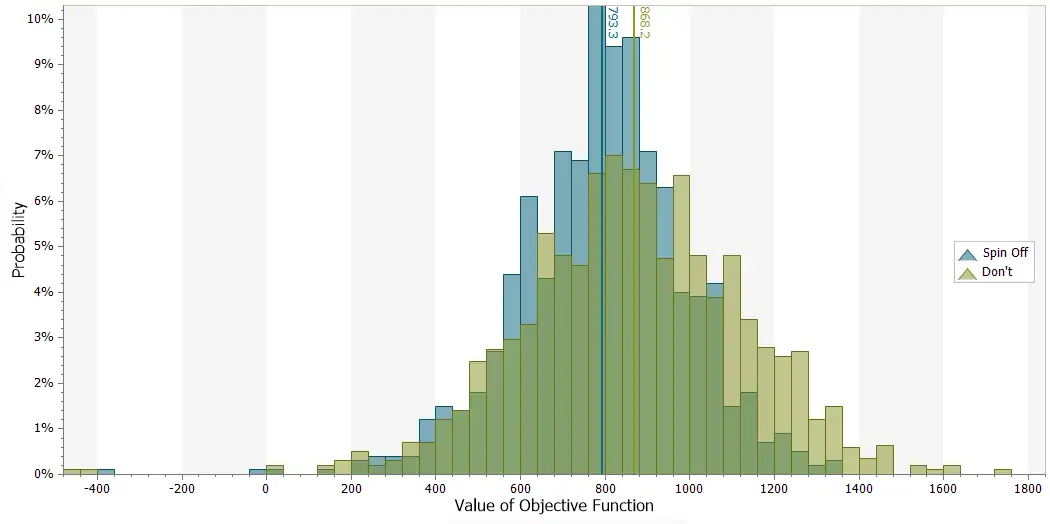

DPL can produce a variety of insightful outputs with a Monte Carlo Simulation run, including:

- Risk Profiles

- Initial Decision Alternatives

- Policy Tree

- Policy Summary

BEST-IN-CLASS DECISION TREE SOFTWARE

DPL is a Comprehensive, Scalable Discrete Tree and Monte Carlo Simulation Software Tool for Performing Robust Risk & Decision Analytics