Utilities

Cogeneration Investment Decision

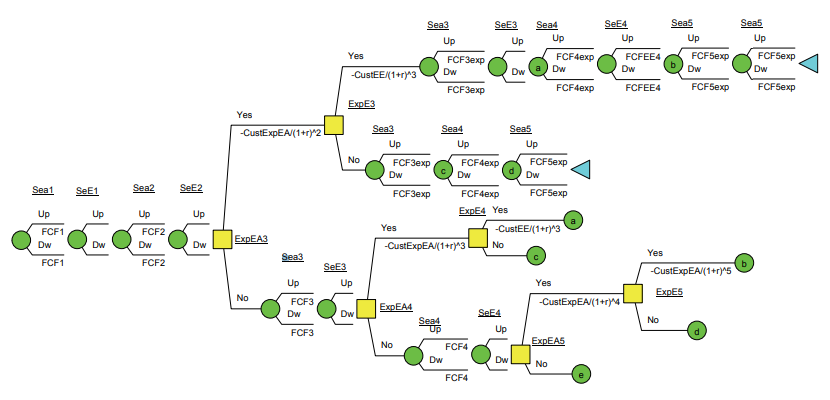

Energy generation from biomass has become a source of increasing interest due to growing environmental concerns and the depletion of the world’s fossil fuel reserves. In this DPL application a sugar and ethanol producing plant has both the option to expand and to add a cogeneration unit to allow the sale of surplus energy that is generated by burning sugar cane bagasse. The existence of the second option is conditional to the exercise of the first option. A real options approach is employed to determine the value of these managerial flexibilities, considering that these options have three distinct underlying assets (sugar, ethanol, and electricity).

The option to expand production is a function of the expected future prices of sugar and ethanol, while the decision to invest in the cogeneration plant depends on the future prices of energy. The analysis results indicate that significant value can be derived from the flexibility to choose the optimal timing of investment in both options. Few sugar cane crushing mills currently have cogeneration units installed, and given the increasing demand for clean and renewable sources of energy, there is significant potential for investment and further development of bioelectricity cogeneration power plants.