Mining

Valuing a Mining Switch Option

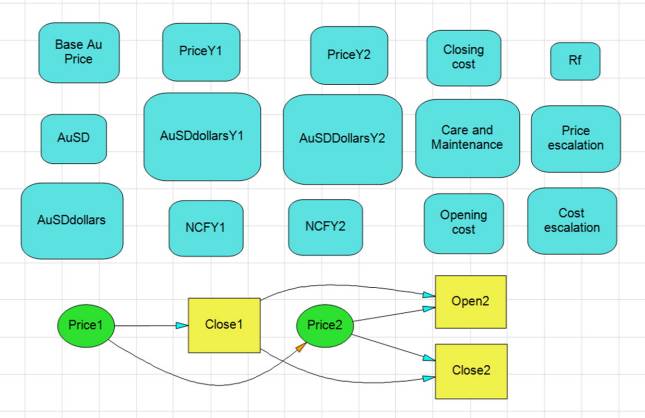

Under current depressed commodity price conditions many mining projects are financially marginal. This calls for a shift from a focus on economies of scale, which can involve significant capital investments and inflexible modes of operation, to making up front investments for operational flexibility – resulting in easier and less costly means to temporarily close and re-open poor performing mines in response to price volatility. DPL is employed to estimate the real option value of this switching option in order to provide an indication of the amount that should justifiably be invested up-front to create the necessary switching flexibility.

Citation: Guj, Pietro, 2011. “A practical real option methodology for the evaluation of farm-in/out joint venture agreements in mineral exploration,” Resources Policy, Elsevier, vol. 36(1), pages 80-90, March.