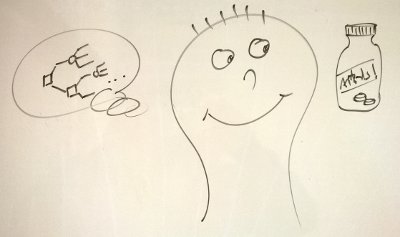

The Wall Street Journal reported recently about a paper that purports to show people are better able to tolerate the “pain” of a difficult decision if they’ve taken acetaminophen, the common pain killer.

Can Tylenol Ease the Pain of a Home Sale?

The pain the paper focused on was loss aversion, the difficulty people have giving up something they’ve owned, and the Journal speculated that the prescription might be helpful when individuals are in the position of selling a house for less than they think it’s worth.

In the context of individual decision making, happiness is a nonlinear function of wealth and loss aversion is not necessarily a disorder to be worked around (e.g., losing your house is more bad than gaining a second home is good). But for business decisions aided by decision analysis, we’re generally talking about the shareholder’s money, and if we assume they’re diversified then acting on loss aversion is contrary to their best interests.

Beyond loss aversion, this research raises some interesting questions for us:

Does acetaminophen help with the pain of probability assessment? In courses, I explain the difference between objective and subjective probability assessment as a measure of discomfort: all probability is subjective and in your head, but it feels safer to rely on specific data (which will somehow insulate you from blame?) than to stick your neck out and do the hard synthesis that only your brain can do.

Does the medicated brain work better (more consistently / closer to the normative ideal) than the unmedicated?

Do other drugs (aspirin, ibuprofen, alcohol, morphine, etc.) have similar effects? In particular, alcohol has a special if unofficial role in business decision making in many countries.