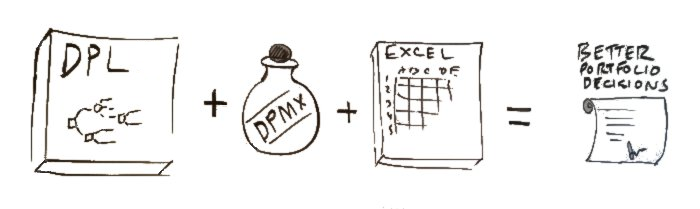

In recent months we at Syncopation have been hard at work on a set of tools we call DPMX, short for DPL Portfolio Management eXtentions. DPMX is a key piece of the puzzle for organizations that want to do portfolio analysis/prioritization based on decision analysis principles and don’t want to get lost in a labrynth of email, spreadsheets and PowerPoint decks.

DPL has been in the decision analysis business for over 20 years and the portfolio decision analysis business for 15. While our single-project/asset evaluation tools, DPL Professional and DPL Enterprise, have always been widely available, the situation with portfolio tools is more complicated. For several years we’ve offered a Portfolio version of DPL, which covers the analytics and serves as a hub for a portfolio decision support system. For a moderate sized portfolio in the hands of a few analysts, DPL Portfolio is all you need to get the job done on the desktop, but as users, projects and general complexity grow, the benefits of a web-based system become acute. We’ve built those systems, using DPL and “other stuff” to create a custom fit for demanding clients, but until now we’ve kept that “other stuff” to ourselves. DPMX puts it all in a box, a kind of starter kit with easy-to-modify examples, so you can easily and quickly whip up an enterprise-grade database-powered intranet portfolio system.

Where does DPMX fit in? Let’s start with what you need to have a successful portfolio decision system.

- A coherent project evaluation methodology, consistently applied

- Flexible, efficient analytics for getting to results with a minimum of compromises

- Compelling, convenient graphical results

- Data management tools that speed the process, eliminate errors and reduce pain for analytical staff

For #1, I favor light decision analysis (reserve full-bore DA for the make-or-break projects) with valuation-oriented DCF (& please keep the discount rate out of the teens, OK?). DPL Portfolio has #2 and #3, in spades.

DPMX gives you #4, right out of the box. If you haven’t had first hand experience of portfolio data management, you might think, “Gee, I can handle pulling the data together without a fancy system. I’ll publish a schedule, email out some examples, and people can email me their models.” The trouble with this approach is that for a medium-to-large portfolio it involves an enormous burden of “data monkey” work – sifting through various spreadsheets to find the right data. Not only is that unpleasant, it takes key people away from the work that matters most: managing the portfolio to create value.

As I’m sure you know, there are plenty of companies who say they have software that will help you manage a portfolio in one way or another. Why use DPL + DPMX? I’ll keep it simple and whittle it down to two:

- DPL

DPL is a full featured influence diagram / decision tree tool you can buy by the yard. It works as well for basic, “10-50-90” models or even (gasp) deterministic models as it does for multi-stage real option humdingers. - Excel

Most of the time, financial analysis types have to choose between Excel, which is open and transparent but totally unmanaged, and a locked down, black box system with concrete walls three feet thick. DPMX gives you the best of both worlds: Excel for the interface and the cash flow calculations but a version tracked database system for the back end, with results in an intranet web page. DPMX spreadsheet templates are real spreadsheets; there is no black box.

We’ll be saying more about DPMX in the weeks and months that follow. If you will be attending the INFORMS annual meeting, we’ll be giving a demo of DPMX on Tuesday, or you can stop by our booth in the exhibit hall.

To request access to the FREE DPMX trial or request a live demo, see the DPMX product page: