The news of the week is that this year’s Nobel Memorial Prize in Economics goes to Ben Bernanke, Douglas Diamond and Philip Dybvig, for their work on banks and financial crises.

A Nobel prize always stimulates a number of articles summarizing the careers of the winners, which are often impressive for many reasons beyond the work named by the awarding committee. Needless to say all three of the winners have made enormous contributions to economic science on the very practical problem of how to avoid depressions. In the case of Ben Bernanke, that contribution even extends to actual decision making as head of the US Federal Reserve, where his work arguably prevented the Great Recession from turning into the second great depression.

Of course smart people often make contributions outside their forte, and Economist and blogger Alex Tabarrok points out another influential paper that Bernanke wrote, Irreversibility, Uncertainty, and Cyclical Investment, which put forth ideas that would later become part of real options analysis, a subject near and dear to our hearts here at Syncopation.

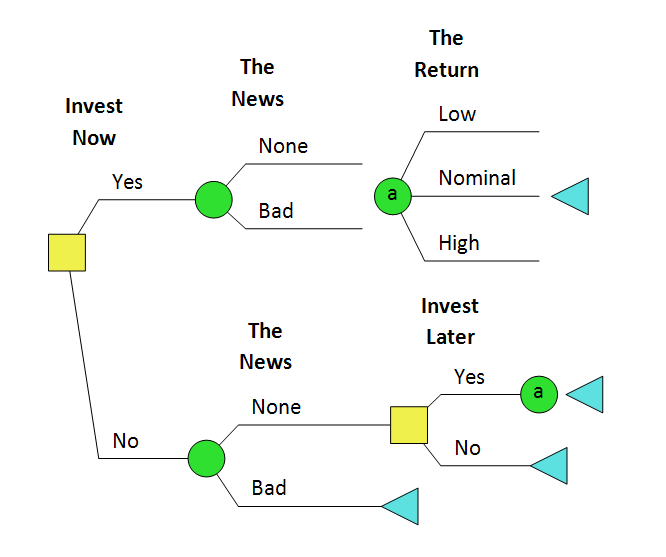

How long should you wait to make an investment? A naive answer is until the expected NPV of the investment is positive. That might be appropriate for a one-time, now-or-never opportunity, but what if you can wait a few months, long enough to resolve a key risk to the downside? Does that option value outweigh what you forgo by not investing earlier? To answer that question, you need some kind of a model, something like this decision tree.

Investment Decision Tree

You can download the DPL Decision tree here.

The essential point is that you can invest later, but you can’t uninvest – once you’ve put in the money, there is no exit option if things go wrong. If you invest now, bad news is something that happens to you. If you hold off, maybe you read about that bad news in the paper and breathe a sigh of relief that you didn’t invest – “sucks bein’ them”, as the saying goes. Also, in this model “no news is good news”, we’re not talking about early stage investments where the news might be that our startup has hit a home run, we’re mostly worried about things not going according to plan.

To put a value on that “option to wait” we’d need to populate this model (or some more granular variant of it) with actual numbers. However, we can make some off the cuff qualitative conclusions. In a time of great uncertainty – simplistically, a higher probability of bad news – that option to wait will be worth more than in more stable times. What if the environment is such that many investments are subject to the same big risks? Well, everybody decides to wait, and we get the business cycle. From the abstract:

- “… when individual projects are irreversible, agents must make investment timing decisions that trade off the extra returns from early commitment against the benefits of increased information gained by waiting. In an environment in which the underlying stochastic structure is itself subject to random change, events whose long-run implications are uncertain can create an investment cycle by temporarily increasing the returns to waiting for information”

In conclusion, thanks to Bernanke, Diamond and Dybvig for hard thinking on avoiding depressions and more.